What you need to know

If you decide to sell your home and buy a new one because you’ve been assigned to a new duty station, you can get a refund for some of the associated legal expenses. You can also use it to contribute towards the legal costs that arise when letting your home, or if you need to repossess your home.

It is important that you have read and understood JSP 752 Tri-Service Regulations for Expenses and Allowances (chapter 12, section 3) before proceeding.

To be eligible, you must be in possession of a permanent assignment order that requires you to move to a new duty station, and which clearly indicates a likelihood of serving a minimum of 12 months at the new duty station. This is available to Regular, Reserve and Military Provost Guard Service personnel in connection with the sale and purchase of a Residence at Work Address (RWA). Only Regular and Reserve Service personnel are entitled to this benefit in connection with letting a RWA.

For legal fees in respect of letting and repossession, your assignment order must clearly indicate that you are likely to serve at least 6 months (182 days) at the new duty station.

A RWA is a residence (e.g. house, flat) occupied by a Service person for a minimum period of 6 months either at the present duty station or a previous duty station, from which they commute to and from their place of duty on a daily basis. It must normally be an address within 50 miles (or 90 minutes travelling time by public transport) of your duty station.

The maximum allowance rate is £5,000. In order to claim this allowance, you must provide documentary evidence and fulfil all of the conditions set out in JSP 752.

What you need to do

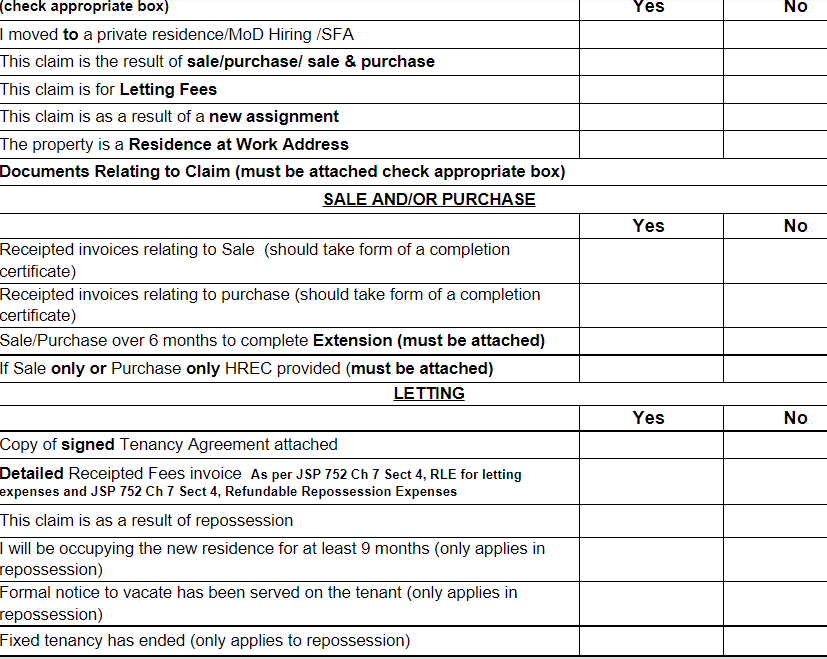

You need to complete JPA Form 004 and submit it to your Unit HR Admin or Personnel Office with all supporting paperwork.

The form will ask you for the following information:

Payment of approved claims will be made through your bank account up to the maximum threshold.